How to Run a Business in Islam – Complete Guide to Islamic Business Ethics and Practices

By: Javid Amin | 16 Aug 2025

Why Islamic Business Ethics Matter

Islam is more than just a set of rituals—it is a holistic way of life that illuminates every action, including how we earn, spend, and manage wealth. In today’s fast-paced global economy, where profit often eclipses principle, Islamic business ethics provide a timeless blueprint for integrity, fairness, and social upliftment.

Running a business in accordance with Islamic values isn’t simply about avoiding what is forbidden (haram), but about striving to build trust, foster communities, and ultimately seek the pleasure of Allah. From ethical decision-making to fair transactions, Islamic principles instill a unique sense of responsibility upon Muslim entrepreneurs to be exemplary both as business leaders and as citizens.

“Islamic business ethics are designed to create a balance between profit and purpose, ensuring that the pursuit of wealth does not come at the expense of justice, honesty, or the welfare of society.”

Foundations of Islamic Business: Quran, Sunnah, and Shariah

The roots of Islamic business principles can be traced to three crucial sources that together form a comprehensive guide for ethical entrepreneurship:

01. The Qur’an

The Quran is the divine framework for moral conduct in every sphere of life, including commerce. Allah legislates clear guidelines for trade, contracts, and financial transactions, advocating honesty, fairness, and lawful earning.

“Allah has permitted trade and forbidden interest.” — Surah Al-Baqarah (2:275)

02. The Sunnah

Prophet Muhammad ﷺ, long before his prophethood, was known as Al-Ameen (The Trustworthy). His reputation for integrity, transparency, and compassion in business set timeless standards for all who follow his example. The Sunnah—his sayings, actions, and approvals—enriches our understanding and application of the Quranic business ethics.

03. Shariah Law

Shariah is the Islamic legal framework that shapes contracts, finance, and trade. It outlines the boundaries of permissible (halal) and impermissible (haram) practices, ensuring all business activities are conducted with honor and justice.

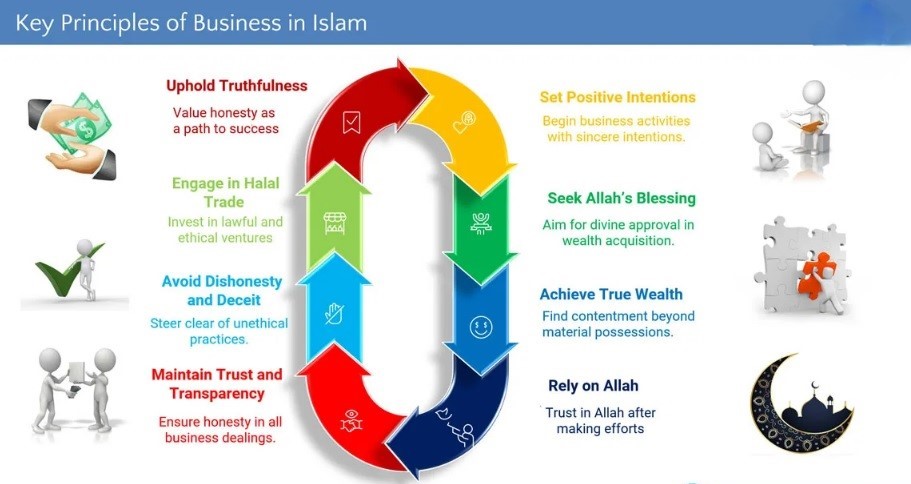

Do’s of Running a Business in Islam

Muslim entrepreneurs are expected to be beacons of integrity and fairness. Here are the essential acts every Muslim businessperson must uphold:

01. Sell Lawful (Halal) Products

Only offer goods and services that are permitted in Islam. This means avoiding alcohol, pork, gambling, and anything indecent or harmful.

“O you who believe! Eat of the lawful things that We have provided you.” — Surah Al-Baqarah (2:172)

02. Be Honest and Transparent

Truthfulness is at the heart of every transaction. Avoid exaggeration, misrepresentation, or lies in marketing and sales.

“The honest and trustworthy merchant will be with the Prophets, the truthful, and the martyrs.” — Sunan al-Tirmidhi

03. Fulfill Contracts and Agreements

Contracts in Islam are sacred. All parties must honor their word and fulfill agreements in business dealings.

“O you who have believed, fulfill [all] contracts.” — Surah Al-Ma’idah (5:1)

04. Pay Employees Fairly and Promptly

Islam commands justice in wages and timely payment for all employees. Delaying wages is an act of injustice.

“Give the worker his wage before his sweat dries.” — Ibn Majah

05. Practice Fair Pricing and Avoid Exploitation

Set prices with justice, neither overcharging nor exploiting the needy or unaware.

“Give full measure and weight in justice.” — Surah Al-An’am (6:152)

06. Engage in Ethical Marketing

Represent your products truthfully. Avoid deception, manipulation, or false advertising.

07. Give Regular Charity (Zakat and Sadaqah)

Business is an opportunity to give back. Regular charity cleanses business transactions of possible errors and brings divine blessings.

“O businessmen, transactions carry lies and false oaths, so add charity to your business.” — al-Nasa’i

Don’ts of Business According to Islamic Teachings

Certain practices are categorically forbidden in Islamic commerce and must be strictly avoided to remain righteous:

01. Avoid Riba (Interest)

Charging or paying interest is strictly prohibited.

“Allah has permitted trade and forbidden interest.” — Surah Al-Baqarah (2:275)

02. No Fraud or Deception

Any form of cheating or misrepresentation is a grave sin.

“Whoever cheats us is not one of us.” — Sahih Muslim

03. Don’t Hoard or Create Artificial Scarcity

Artificial inflation of prices by hoarding is strictly forbidden.

“He who hoards is a sinner.” — Sahih Muslim

04. Avoid Gharar (Uncertainty) and Maysir (Gambling)

Business contracts must be free from excessive uncertainty, ambiguity, or speculation.

05. Don’t Delay Payments Unjustly

Withholding payments without just cause is an act of oppression.

“Delaying payment by a rich person is injustice.” — Sahih al-Bukhari

Key Quranic Verses and Hadiths on Business Conduct

| Source | Quote | Theme |

|---|---|---|

| Quran 4:29 | “Do not consume one another’s wealth unjustly, but only [in lawful] business by mutual consent.” | Fair trade |

| Hadith | “The truthful merchant is with the Prophets.” | Honesty |

| Quran 83:1-3 | “Woe to those who give short measure…” | Justice in transactions |

| Hadith | “Why did you not put the rain-damaged food on top?” | Transparency |

Halal Business Models and Financing

Islam encourages business models that connect real economic activity with ethical risk-sharing. Avoid conventional loans with interest and seek Shariah-compliant financing:

01. Mudarabah: Profit-sharing partnership

The financier provides capital, and the entrepreneur manages the business. Both share profits as agreed.

02. Musharakah: Joint venture

All partners contribute and share profits and losses equally.

03. Murabaha: Cost-plus sale

The seller buys goods for a client at their cost price and adds a profit margin.

04. Ijara: Leasing model

Assets are leased rather than sold, with ownership transferred at the end of the term.

05. Sukuk: Islamic bonds linked to assets

Sukuk are investment certificates backed by real, tangible assets, ensuring no speculation or riba.

Obtaining Halal Funding

Seek Shariah-compliant funds through Islamic banks, credit unions, or cooperative models that avoid interest.

Employee Rights and Workplace Ethics

Islam prioritizes dignity and fairness for every worker. Employers must provide:

-

Clear contracts and job descriptions

-

Timely and fair payment

-

Respectful treatment

-

No forced labor or exploitation

-

Opportunities for growth and education

“Your employees are your brothers. Feed them what you eat, clothe them as you clothe yourself.” — Sahih al-Bukhari

Creating an Ethical Workplace

Islam calls for workplaces that foster trust, respect, and excellence. Leaders must listen to employee concerns and create environments that nurture talent and wellbeing.

Social Responsibility and Charity in Business

Businesses, according to Islam, have a purpose far beyond profit. Social responsibility is a non-negotiable aspect. Successful Muslim entrepreneurs are expected to:

-

Pay Zakat on business assets

-

Support local communities

-

Reduce waste and environmental harm

-

Promote ethical sourcing and fair trade

-

Sponsor education, healthcare, and social welfare

“Indeed, the wasteful are brothers of the devils.” — Surah Al-Isra (17:27)

Why Social Responsibility Matters

Supporting meaningful causes and fostering development bring blessings and multiply profits—both in this life and the next.

Common Pitfalls and How to Avoid Them

| Pitfall | Islamic Guidance |

|---|---|

| Greed | Practice moderation and gratitude |

| Dishonesty | Uphold truthfulness and transparency |

| Exploitation | Ensure fairness and mutual benefit |

| Interest-based loans | Use halal financing models |

| Environmental harm | Adopt sustainable practices |

Guarding Against Missteps

Islamic business ethics offer clear remedies for common pitfalls. Cultivate gratitude, fairness, and social concern to stay on the straight path.

Building a Sustainable, Ethical Business

Building a legacy of barakah (divine blessing) begins with pure intentions and follows through every step:

-

Start with pure intentions (niyyah)

-

Choose a halal niche

-

Create transparent systems

-

Treat people with respect and compassion

-

Give back through charity and community service

-

Trust in Allah’s rizq (provision)

“Whoever fears Allah, He will make a way for him and provide for him from where he does not expect.” — Surah At-Talaq (65:2-3)

Malpractice in Business: How Greed Is Poisoning Public Health

Greed and unethical shortcuts in business endanger lives and break public trust. Islam strictly forbids these acts.

“And do not consume one another’s wealth unjustly or send it [in bribery] to the rulers in order that [they might aid] you to consume a portion of the wealth of others unlawfully.” — Surah Al-Baqarah (2:188)

Unhygienic Food and Rotten Meat

Unsafe food leads to millions of illnesses and deaths globally. Key violations include:

-

Selling expired or spoiled meat

-

Using contaminated water

-

Reusing cooking oil

-

Storing food unhygienically

“He who cheats is not one of us.” — Sahih Muslim

Health Impact

-

Food poisoning (e.g., Salmonella, E. coli)

-

Gastrointestinal infections

-

Hepatitis A and cholera

Islamic Guidance

Cleanliness is paramount. Always ensure food is halal (permissible) and tayyib (pure and wholesome).

Fake and Substandard Medicines

1 in 10 medicines in developing countries is substandard, risking millions of lives. Violations include:

-

Selling expired/counterfeit drugs

-

Diluting active ingredients

-

Mislabeling medicines

-

Operating without licenses

“Whoever harms others will be harmed by Allah.” — Sahih al-Bukhari

Health Impact

-

Treatment failure

-

Antimicrobial resistance

-

Deaths from toxic or ineffective drugs

Islamic Guidance

Strict quality control is essential. Health must never be sacrificed for profit.

Synthetic Milk and Dairy Adulteration

Synthetic milk, made from water, detergent, urea, and oils, poses grave risks. Violations include:

-

Mixing synthetic compounds

-

Adding illegal substances

-

Using hormones and preservatives

“Do not defraud people of their property, nor go about spreading corruption in the land.” — Surah Ash-Shu’ara (26:183)

Health Impact

-

Kidney damage

-

Digestive disorders

-

Hormonal imbalance

-

Cancer risks

Islamic Guidance

Milk is sacred, and tampering with it is a serious violation of trust.

Broader Impact on Society

Such malpractices erode communities…

-

Loss of market trust

-

Burdened healthcare systems

-

Economic productivity decline

-

Erosion of moral business culture

“Indeed, Allah commands justice and good conduct and giving to relatives, and forbids immorality, bad conduct, and oppression.” — Surah An-Nahl (16:90)

What Businesses Must Do

To restore dignity and protect public health:

-

Enforce hygiene protocols

-

Ethical sourcing of inputs/medicines

-

Quality checks regularly

-

Staff education on Islamic and food safety ethics

-

Collaboration with authorities to maintain standards

Bottom-Line: Business as Worship

In Islam, business is a form of worship when conducted ethically and for the sake of Allah. Every transaction, handshake, and decision can be infused with sincerity and service to humanity. By integrating these principles, Muslim entrepreneurs build legacies not just of revenue, but of barakah and respect.

Let your business reflect the beauty of Islam—let it inspire trust, nurture communities, and earn the pleasure of Allah.

Frequently Asked Questions (FAQs) on Running a Business According to Islamic Principles

01. What are Islamic business ethics?

Islamic business ethics are guidelines rooted in honesty, fairness, integrity, and justice, drawn from the Qur’an and the teachings of Prophet Muhammad (PBUH). They require business owners and workers to maintain trustworthiness in all actions, ensuring transactions benefit all parties and society at large.

02. Why is honesty crucial in Islamic business?

The Prophet Muhammad (PBUH) taught that honesty is essential in business. He stated, “The truthful and honest merchant is with the Prophets, the truthful, and the martyrs.” This means that truthful business dealings build trust, attract barakah (blessing), and are beloved to Allah.

03. Can Muslims engage in any type of business?

Muslims are only permitted to engage in halal (permissible) businesses. Activities involving alcohol, gambling, usury, or anything deemed harmful or unlawful in Islam are not allowed. Halal business upholds moral and ethical standards for the benefit of all.

04. What is riba, and why is it prohibited?

Riba is the practice of charging or paying interest on loans. It is strictly prohibited because it promotes exploitation and injustice within society, leading to economic inequality and undermining social welfare—clearly contradicting Islamic values.

05. What makes a business transaction halal?

A halal business transaction is one where the object, process, and outcomes are all permissible under Islamic law. The products must be lawful, both parties must act transparently, contracts must be honored, and transactions must be free from interest, gambling, fraud, and excessive uncertainty (gharar).

06. What is gharar and why must it be avoided?

Gharar refers to excessive uncertainty, ambiguity, or hazard in business contracts. Transactions with unclear terms, unknown prices, or speculative risks are forbidden as they can result in injustice and harm one party. Clear, well-defined agreements are a must in Islamic business ethics.

07. How is profit shared in Islamic business models?

Profit-sharing models such as Mudarabah and Musharakah are encouraged. In Mudarabah, one party provides capital while the other provides expertise, and profits are shared according to pre-agreed ratios. Losses, however, are borne by the capital provider unless caused by negligence.

08. What role does zakat play in business?

Zakat is a mandatory almsgiving that purifies one’s wealth. Muslim business owners are required to pay zakat on eligible business profits and assets annually. This fosters social equity and redistributes wealth within the community, reinforcing social responsibility.

09. Are partnerships allowed in Islam?

Yes, partnerships (sharikah) are encouraged if based on mutual trust, fairness, and transparency. Contracts must clearly define each partner’s rights, responsibilities, and profit-sharing ratios to prevent disputes.

10. Can non-Muslims benefit from or participate in Islamic business or banking?

Absolutely. Islamic banking and ethical business practices are open to all, regardless of faith. Many non-Muslims choose Islamic banking for its emphasis on risk sharing, transparency, and social responsibility.

11. How does Islamic finance avoid interest while remaining profitable?

Islamic banks and financiers use asset-backed transactions, leasing arrangements, and profit-sharing contracts. Profits are generated through trade, investment, fees, and service charges instead of charging or paying interest.

12. Is ethical advertising important in Islam?

Yes. Islamic guidelines strictly prohibit deceptive, misleading, or exploitative advertising. Marketers must always uphold truthfulness, transparency, and cultural sensitivity, ensuring that all claims are honest and substantiated.

13. What are Islamic guidelines for employee treatment?

Islam requires treating employees with respect and justice—providing fair wages promptly, ensuring safe working conditions, and fostering opportunities for growth. Employers should never exploit workers and are encouraged to view employees as partners in success.

14. What are the most common mistakes made by Muslim entrepreneurs?

Some frequent errors include lack of transparency, delayed payment of dues, mixing halal with haram income, neglecting regular zakat, and failing to keep contracts clear. Avoiding these mistakes is vital for both personal integrity and business sustainability.

15. How does Islam view business success?

True business success in Islam is achieving profit ethically while serving society and earning the pleasure of Allah. Material success should never come at the cost of morality, social justice, or spiritual well-being.

16. Can digital businesses and e-commerce be halal?

Yes, provided that the products sold and services offered are halal, contracts are clear, and transactions remain free of interest, fraud, and unethical practices. Online businesses must also respect privacy and avoid selling prohibited items.

17. How should a Muslim entrepreneur handle discovering malpractice in their business?

They must immediately cease the malpractice, seek forgiveness from Allah, rectify any harm done, and put in place clear Shariah-compliant systems to prevent future occurrences. Ethical accountability is a top priority in Islam.

18. Is it allowed to name businesses after holy Islamic terms?

This is permissible if the name is used respectfully and not exposed to disrespect or misuse in any business activity.

19. How does Islamic business ethics promote social and environmental responsibility?

Islamic teaching obligates business owners to avoid waste, reduce harm to the environment, and use resources responsibly. Supporting community welfare through charity, ethical sourcing, and environmentally friendly practices is strongly encouraged.

20. Do Muslim business owners have unique responsibilities on Judgment Day?

Yes. Every business person will be asked about how wealth was earned and spent. Honesty, fairness, and social responsibility in all business dealings are rewarded in the Hereafter, emphasizing that business is a form of worship.